Recommended Posts

Kennedy 0

... Congress was at liberty under the amendment to tax as income, without apportionment, everything that became income, in the ordinary sense of the word, after the adoption of the amendment,

An important principle taken from Eisner v. Macomber is that the word "income" in the Sixteenth Amendment is generally given its ordinary plain English meaning, and wealth and property that is not income may not be taxed as income by the Federal Government.

And as has been pointed out to you, tax code specifies what income they count. So are you the only one here who doesn't know what income means?

Now get back under your bridge.

Guard your honor, let your reputation fall where it will, and outlast the bastards.

1*

nanook 1

I'm not saying it "nullifies the law".

I'm merely pointing out that if "income " hasn't been legaly defined there is no way you can proove ,nor can I determine whether or not I had "income" under that section of law.

Now we are getting somewhere. "Income" itself, has been legally defined for the IRS. It doesn't need to be defined in the Tax Code:

"instances of [1] undeniable accessions to wealth, [2] clearly realized, and [3] over which the taxpayers have complete dominion" (Commissioner v. Glanshaw Glass Co.) This court case standardized the meaning of "income" for taxable purposes.

The Supreme Court defined "income" during a tax case. I say the IRS does not have the burden of proof. Especially since the Supreme Court found in favor of the IRS.

"The trouble with quotes on the internet is that you can never know if they are genuine" - Abraham Lincoln

Andy9o8 2

The Supreme Court defined "income" during a tax case. I say the IRS does not have the burden of proof. Especially since the Supreme Court found in favor of the IRS.

Ah, but you forget: the Supreme Court are federal judges, and they all have to recuse themselves. Resulting in nobody left with jurisdiction to decide federal tax law. Except trolls under bridges.

billvon 3,090

>It's just an illusion.

There ya go. And if it's imaginary, then you have no claim to it.

>Money?

>It's just an illusion.

There ya go. And if it's imaginary, then you have no claim to it.

Originally employed as a weapon of war, the hammer nowadays is used as a

kind of divining rod to locate the most expensive parts adjacent the

object we are trying to hit.

It seems everybody but you understands what income means. The Supreme Court said so.

... Congress was at liberty under the amendment to tax as income, without apportionment, everything that became income, in the ordinary sense of the word, after the adoption of the amendment,

An important principle taken from Eisner v. Macomber is that the word "income" in the Sixteenth Amendment is generally given its ordinary plain English meaning, and wealth and property that is not income may not be taxed as income by the Federal Government.

And as has been pointed out to you, tax code specifies what income they count. So are you the only one here who doesn't know what income means?

Now get back under your bridge.

For some reason, this 'jmbrown' sounds real familiar but 'jmbrown' is a different monicker. Hmmmm...

Chuck

WoW! Another thread started for the sole purpose of starting an argument. Whowoodathinkit?

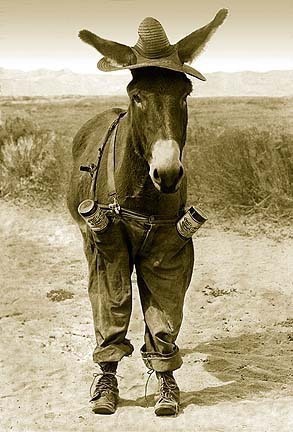

![]()

I think we're all Bozos on this bus.

Falcon5232, SCS8170, SCSA353, POPS9398, DS239

pirana 0

I'm not saying it "nullifies the law".

I'm merely pointing out that if "income " hasn't been legaly defined there is no way you can proove ,nor can I determine whether or not I had "income" under that section of law.

Peace,

Jim B

Look at your W-2's and other funny little slips of paper sent to you shortly after New Year's. They will tell you if you had income. But go ahead and use your strategy to not pay taxes on it; let us know how it ends up.

This supersillious arguement reminds me of Dennis Miller's comeback to the stoner who profoundly asks how he knows that the color red for him is the same color red for everybody else. Miller's reply"

"Check the Crayola box momenschwanz."

We could send him cigarettes at Leavenworth!?![]()

![]()

Chuck

.thumb.jpg.4bb795e2eaf21b8b300039a5e1ec7f92.jpg)

Since you think Clinton's "is" defense was a raving success it is easy to see why you are so confused about other matters.

Originally employed as a weapon of war, the hammer nowadays is used as a

kind of divining rod to locate the most expensive parts adjacent the

object we are trying to hit.

Share this post

Link to post

Share on other sites